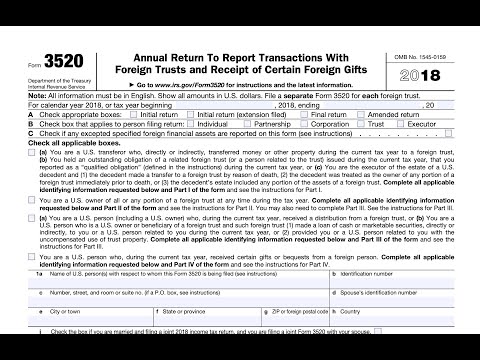

Hello, this is Prog Patel, the tax attorney. I am here to talk to you about Form 3520-A and the receipt of foreign gifts. This form is often misunderstood, and I receive many inquiries about it. The common story is that individuals receive a foreign gift or inheritance from a parent abroad and have failed to report it. So, how do you report it? The answer is generally Form 3520-A. Form 3520-A is required when a person receives more than $100,000 worth of foreign assets in any calendar year. The first part of the form, which needs to be completed, is the top half where you identify the relevant tax year and your filing status. If you received a gift or inheritance from a foreign person, you need to complete Part IV of the form. This means you don't have to complete a lot of the other sections. Just provide the name and address of the donor, and skip to page six. On page six, in Part IV, you need to check the that states you received a gift worth more than $100,000. Then, you should complete Question 54 to provide a description of the property received and its fair market value. This is an important disclosure because many people see this form as a burden, but it actually presents an opportunity. In my opinion, this form allows you to memorialize a step-up in basis if you received a fair market value foreign asset as a result of someone's passing. In simpler terms, when you receive a foreign asset, you get a step-up in basis, which determines its taxable value when sold. By disclosing this on Form 3520-A, you can inform the IRS about the fair market value on the date the person who gave it to you died. Normally, there is no place...

Award-winning PDF software

3520 A beneficiary statement Form: What You Should Know

From January 2025 through November 2023. File an estimated tax Return. For tax year 2018. To file quarterly, we need your monthly employment income and gross receipts for the first three months of the year. Also need a breakdown of the estimated taxes and estimated tax payments from the first three months. For Quarterly return, please use Schedule C of the quarterly section of Form 941, Employer's Annual Federal Tax Return to file. You CAN report your taxable wages on schedule C if you are filing a 1099 and have wage withholding instructions; if you do not have wage withholding instructions then you get to file on 830-R, Quarterly Tax Return (Employer's Annual). For quarterly return, you will need an actual pay stub for each pay period. For quarterly return, you cannot include the first three months of income. To file quarterly, fill out Schedule C of Schedule 941, Quarterly Federal Tax Return For Quarterly, we need your weekly and monthly income information; our estimate for withholding plus estimated taxes and estimated tax payments. To have your quarterly estimated tax payment on Form 941, you need to complete Schedule 1. You CAN get your quarterly estimated tax payment on 830-R, Quarterly Tax Return (Employer's Annual). For Quarterly and other schedules, you fill them out at your leisure. Do not use a work-related computer or smartphone for this form. We want to have your quarterly estimated tax payment on 830-R, Quarterly Tax Return (Employer's Annual). For Quarterly and other schedules, you fill them out at your leisure.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 3520-a, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 3520-a online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 3520-a by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 3520-a from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 3520 A beneficiary statement